Create Your Own ETF with This App

In recent years, the popularity of exchange-traded funds (ETFs) has soared as investors look for efficient and diversified investment options in the stock market. ETFs function similarly to mutual funds but are traded on exchanges like stocks. The global number of ETFs has experienced a remarkable surge, increasing from 276 in 2003 to a staggering 8,754 by 2022.

ETFs provide notable benefits like diversification and liquidity. However, retail investors often desire the ability to create and invest in their own ETFs. The Share Invest app makes this possible by enabling users to quickly create, invest in, and share their personalized ETFs within seconds.

You are in control

One of the limitations of ETFs is that they do not provide investors with complete control over the individual securities within the fund. When investing in an ETF, investors are essentially relying on the fund manager’s decisions regarding the composition and allocation of assets. This lack of control means investors cannot selectively exclude specific holdings or make indiåvidual adjustments to align with their personal investment preferences or values.

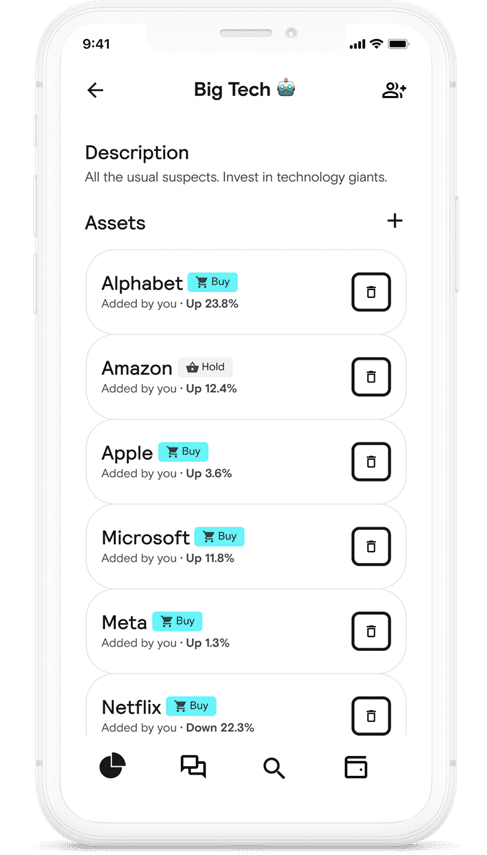

With Share’s personal ETF feature, users have more control over their investments without needing to spend a lot of time on research. It allows users to create, publish, and manage Strategies, which are customized combinations of stocks and/or ETFs designed for specific goals like focusing on certain industries, protecting against market ups and downs, or copying the investments of famous people like Nancy Pelosi and Warren Buffett.

Create good habits with Dollar Cost Averaging

Another limitation of ETFs is the need to consider market timing and starting with a lump sum investment. Investors often face the challenge of deciding when to enter the market and whether it is the right time to make a substantial initial investment. This can lead to hesitation and potential missed opportunities. Additionally, some investors may not have a large lump sum of money readily available for investment, which can restrict their ability to participate in certain ETFs.

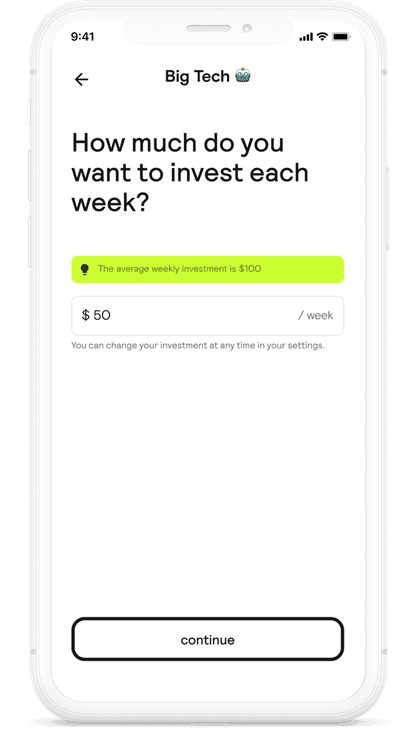

Share’s dollar cost averaging (DCA) feature solves this. DCA is an investment strategy where you invest a fixed amount of money regularly, whether the prices are high or low. This technique allows investors to obtain a favorable average price over time. With Share, users can conveniently establish weekly recurring investments in one or more Strategies, and the app takes care of automatically purchasing all the stocks within the chosen Strategies on their behalf. Use Share’s DCA calculator to test your investment ideas.

Select from a variety of ready-made baskets

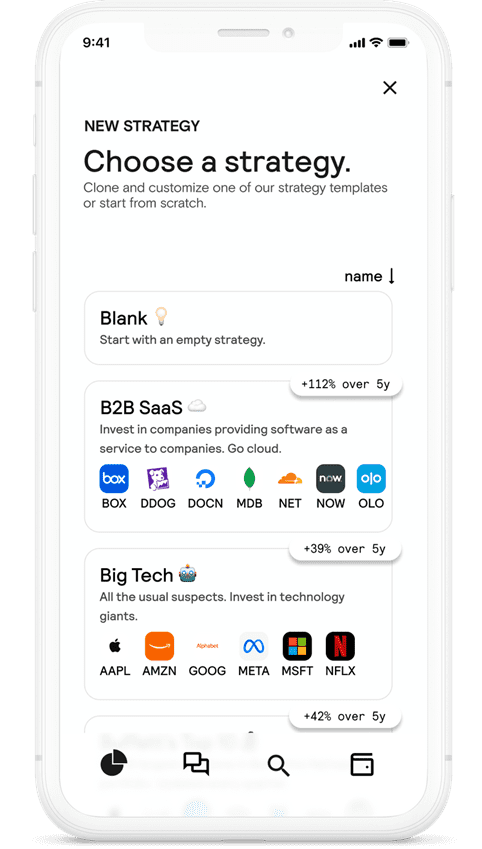

As an SEC-registered investment advisor, Share is legally obligated to prioritize the interests of investors over its own. This ensures that investors’ needs are the primary focus. Furthermore, this registration allows Share to develop pre-made themed baskets, providing users with convenient investment options tailored to specific themes or sectors.

Whether your interests lie in popular subjects like AI or Renewables, or if you seek to emulate renowned figures such as Nancy Pelosi or successful fund managers like Warren Buffett, Share offers a selection of pre-made themed baskets to cater to those preferences.

When you create your own ETF using Share, you can leverage the advantages of an ETF, such as diversification and liquidity, while also relishing the opportunity to personalize your own basket. This allows for stress-free investing through the use of Dollar Cost Averaging (DCA) and saves valuable time with the convenience of pre-made themed baskets that align with your interests.